1

This section allows you to view all posts made by this member. Note that you can only see posts made in areas you currently have access to.

2

Movies & TV / Re: FREE Movies available to BUY on Amazon (and one to Rent for FREE)

« on: April 04, 2024, 04:15:23 PM »

Ehhh.... They called it a pricing error and took it all back anyway.

3

Movies & TV / FREE Movies available to BUY on Amazon (and one to Rent for FREE)

« on: March 27, 2024, 02:56:59 PM »

These you can buy for FREE on Amazon right now

2001: A Space Odyssey (UHD)

https://www.amazon.com/dp/B000GOUXES

The Fugitive (UHD)

https://www.amazon.com/dp/B008Y7YI6I

A Christmas Story

https://www.amazon.com/dp/B009IU78LM

The Replacements

https://www.amazon.com/dp/B001EPUMLW

Ernest Saves Christmas

https://www.amazon.com/dp/B010PS4EJO

A Nightmare on Elm Street (1984)

https://www.amazon.com/dp/B0CD34M8F9

You, Me and Dupree

https://www.amazon.com/dp/B002FQVNLW

And this one you can Rent for FREE

Beetlejuice (UHD)

https://www.amazon.com/dp/B0091W0ILY

But before you "Purchase" You Me and Dupree, make sure you activate your Universal Account so you can get 500 points

https://myuniversalrewards.com/home

2001: A Space Odyssey (UHD)

https://www.amazon.com/dp/B000GOUXES

The Fugitive (UHD)

https://www.amazon.com/dp/B008Y7YI6I

A Christmas Story

https://www.amazon.com/dp/B009IU78LM

The Replacements

https://www.amazon.com/dp/B001EPUMLW

Ernest Saves Christmas

https://www.amazon.com/dp/B010PS4EJO

A Nightmare on Elm Street (1984)

https://www.amazon.com/dp/B0CD34M8F9

You, Me and Dupree

https://www.amazon.com/dp/B002FQVNLW

And this one you can Rent for FREE

Beetlejuice (UHD)

https://www.amazon.com/dp/B0091W0ILY

But before you "Purchase" You Me and Dupree, make sure you activate your Universal Account so you can get 500 points

https://myuniversalrewards.com/home

4

Movies & TV / Re: (NEW Poll Added!!) New Movies/TV Shows we should keep an eye out for!

« on: March 18, 2024, 11:59:31 AM »

Welcome to the POOHNIVERSE!!!

https://imgur.com/oT4RwSx

https://variety.com/2024/film/global/poohniverse-monsters-assemble-winnie-the-pooh-blood-honey-crossover-horror-1235943425/

Blood and Honey and all the other extremely low budget children's tales turned Horror in the last few years are gonna Cross Over into a not as low budget(?) travesty?

I'm not sure if I should be excited at just the idea of them attempting this, or disgusted because I know it gonna be absolute TRASH thrown in the dumpster and then set on fire.

I haven't seen the majority of the movies that they are mashing together (well, really, I haven't seen any of them except for B&H and didn't know most of the rest even existed), but I'm sure I'll at least attempt to check this out if they put a real effort into it at least looking good. B Horror is a guilty pleasure of mine after all.

I mean...

I'm sure some of you have actual reason to the Why Not? question, but honestly, why not?

edit: on second thought...

Tons of upcoming terrible low budget B horror incoming, but if they can make it entertaining, then I'm all for it.

TCU/Poohniverse Let's Gooooo!!

https://imgur.com/oT4RwSx

https://variety.com/2024/film/global/poohniverse-monsters-assemble-winnie-the-pooh-blood-honey-crossover-horror-1235943425/

Blood and Honey and all the other extremely low budget children's tales turned Horror in the last few years are gonna Cross Over into a not as low budget(?) travesty?

I'm not sure if I should be excited at just the idea of them attempting this, or disgusted because I know it gonna be absolute TRASH thrown in the dumpster and then set on fire.

I haven't seen the majority of the movies that they are mashing together (well, really, I haven't seen any of them except for B&H and didn't know most of the rest even existed), but I'm sure I'll at least attempt to check this out if they put a real effort into it at least looking good. B Horror is a guilty pleasure of mine after all.

I mean...

Quote

Where "Avengers: Infinity War" had Iron Man, Spider-Man, Black Panther and Thanos, "Poohniverse" — from prolific horror collaborators Jagged Edge Productions and ITN Studios — will team Winnie the Pooh with murderous versions of figures including Bambi, Tinkerbell, Pinocchio, Peter Pan, Tigger, Piglet, The Mad Hatter and Sleeping Beauty for an IP-bludgeoning frenzy due for release in 2025. Indeed, on the poster, which Variety is also able to exclusively reveal, Pooh is seen swinging a bear trap on a chain while riding a vicious, bloodthirsty Bambi. Because why not?

I'm sure some of you have actual reason to the Why Not? question, but honestly, why not?

edit: on second thought...

Quote

Many of the characters set to appear in "Poohniverse" will first feature in standalone films coming this year and falling under Jagged Edge's version of the MCU, the Twisted Childhood Universe. Among them are "Bambi: The Reckoning," "Peter Pan's Neverland Nightmare" and "Pinocchio Unstrung," plus last year's "Winnie the Pooh: Blood and Honey" and its sequel "Winnie-the-Pooh: Blood and Honey 2," which is being released theatrically in the U.S. on March 26. The upcoming films will include various easter eggs linking them toward the upcoming horrifying crossover.

Tons of upcoming terrible low budget B horror incoming, but if they can make it entertaining, then I'm all for it.

TCU/Poohniverse Let's Gooooo!!

5

General Gaming / Re: Oculus Quest 2: Entering the VR from the comfort of my BR

« on: March 08, 2024, 02:20:10 AM »Sounds like the PSVR2 is supposed to get a PC hookup.

I've never used used it, but does that mean it's gonna be compatible with all/most the VR games available on PC at some point?

Sounds promising, but my guess is the game your playing needs to already be PSVR2 compatible, but now you can play the PC version? Do you have a link for where you read this?

https://www.gamesradar.com/sony-just-casually-announced-psvr-2s-biggest-upgrade-yet-and-im-ecstatic/

https://www.theverge.com/2024/2/22/24079928/sony-psvr2-pc-support-2024

6

Movies & TV / Re: (NEW Poll Added!!) New Movies/TV Shows we should keep an eye out for!

« on: March 07, 2024, 10:37:34 AM »

Fallout

they are opening The Vault on April 11th

https://www.youtube.com/watch?v=V-mugKDQDlg

I don't know how many of you remember the original game for this, but the show looks pretty good based on what I remember from that game. Never got into the more recent sequels, but I'm sure I'll be all into this, as all the episodes drop 4/11

they are opening The Vault on April 11th

https://www.youtube.com/watch?v=V-mugKDQDlg

I don't know how many of you remember the original game for this, but the show looks pretty good based on what I remember from that game. Never got into the more recent sequels, but I'm sure I'll be all into this, as all the episodes drop 4/11

7

General Gaming / Re: Oculus Quest 2: Entering the VR from the comfort of my BR

« on: March 03, 2024, 04:55:23 PM »

Sounds like the PSVR2 is supposed to get a PC hookup.

I've never used used it, but does that mean it's gonna be compatible with all/most the VR games available on PC at some point?

I've never used used it, but does that mean it's gonna be compatible with all/most the VR games available on PC at some point?

8

General Gaming / Re: Oculus Quest 2: Entering the VR from the comfort of my BR

« on: February 28, 2024, 11:31:16 PM »

I heard it's a nice leap forward, but it's also a lot more expensive.

I'm waiting till the price gets cut in half before even thinking of jumping in.

I'm waiting till the price gets cut in half before even thinking of jumping in.

9

Movies & TV / Re: Deadpool & Wolverine Teaser Trailer!!!

« on: February 15, 2024, 11:59:04 PM »

I know everyone here has already seen this, but I haven't really updated this thread in a while, at least not with much enthusiasm. Well, here is all my ENTHUSIASM!!!!

https://www.youtube.com/watch?v=xW-zNOT4P1A

and in Other MCU News.....

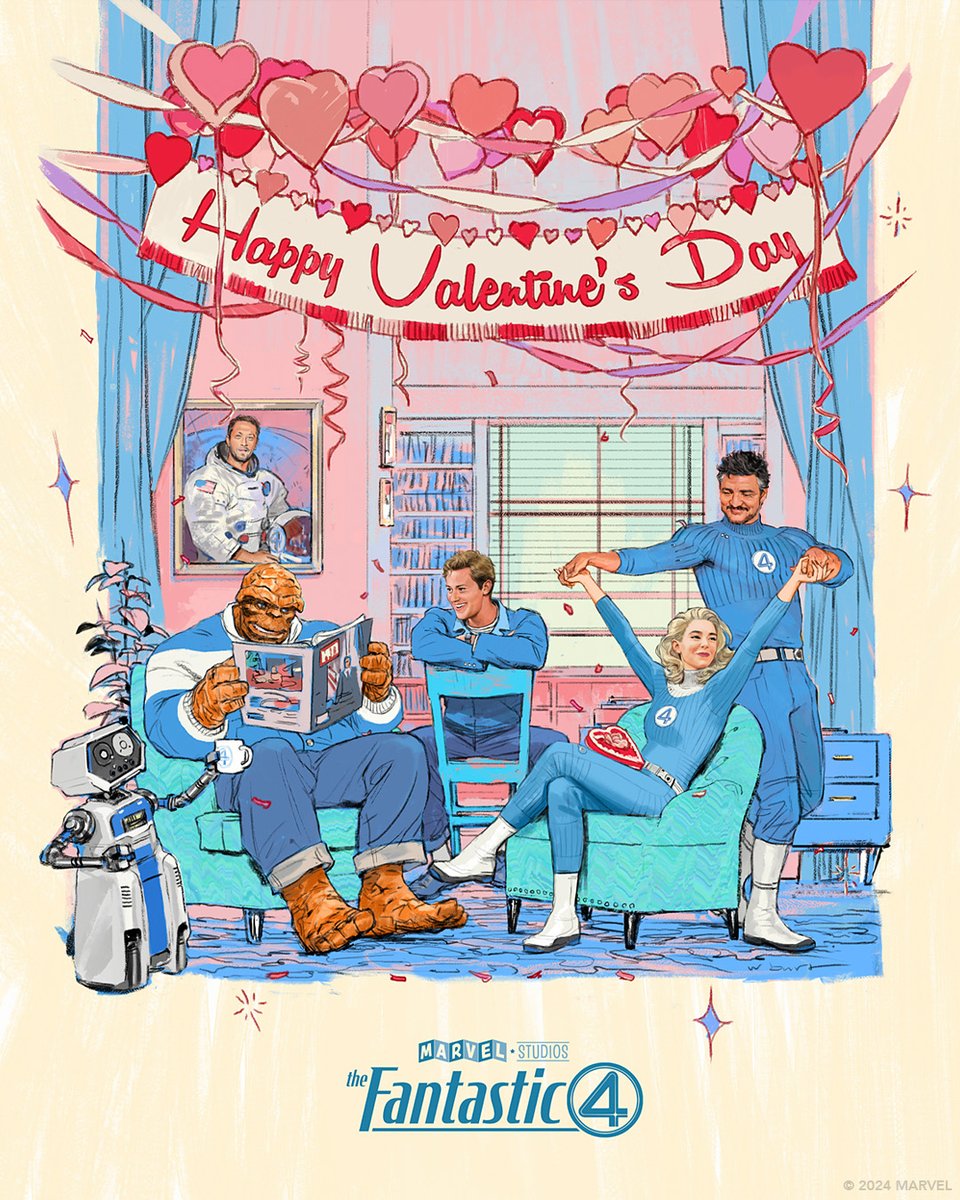

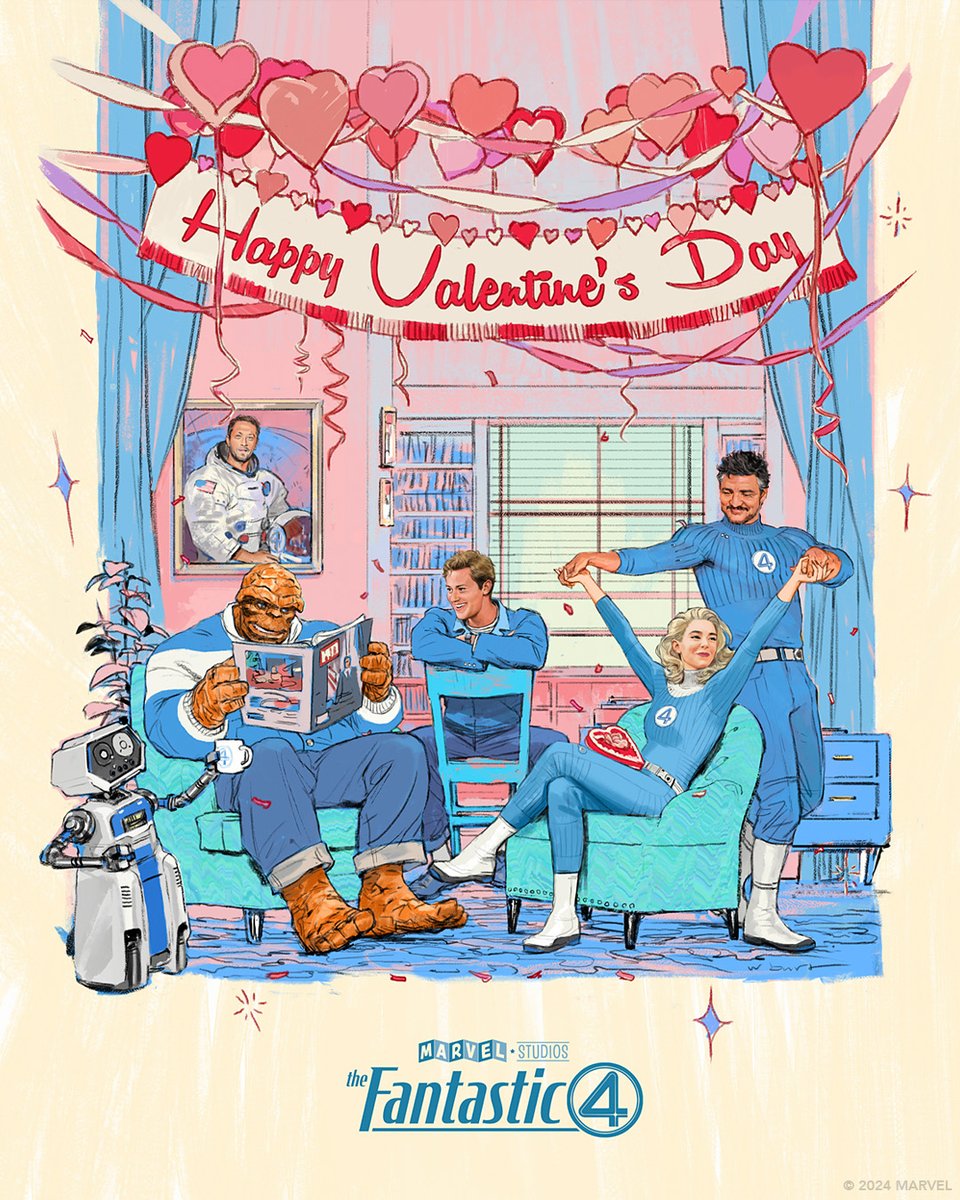

Fantastic 4 get cast - Pedro Pascual as Mr. Fantastic!!

https://x.com/MarvelStudios/status/1757796892455694452?s=20

Thunderbolts move up on the schedule, and Fantastic 4 moves back....

https://deadline.com/2024/02/marvel-thunderbolts-fantastic-four-release-dates-1235825474/

Next year looks like:

Captain America 4 - February 2025

Thunderbolts - May 2025

Fantastic Four - July 2025

Blade - November 2025

and in Marvel Animation news...

X-Men '97 get a trailer

https://www.youtube.com/watch?v=pv3Ss8o9gGQ

https://www.youtube.com/watch?v=xW-zNOT4P1A

and in Other MCU News.....

Fantastic 4 get cast - Pedro Pascual as Mr. Fantastic!!

https://x.com/MarvelStudios/status/1757796892455694452?s=20

Quote

Pedro Pascal, Vanessa Kirby, Ebon Moss-Bachrach, and Joseph Quinn are The Fantastic Four.

Marvel Studios' #TheFantasticFour, in theaters July 25, 2025.

Thunderbolts move up on the schedule, and Fantastic 4 moves back....

https://deadline.com/2024/02/marvel-thunderbolts-fantastic-four-release-dates-1235825474/

Next year looks like:

Captain America 4 - February 2025

Thunderbolts - May 2025

Fantastic Four - July 2025

Blade - November 2025

and in Marvel Animation news...

X-Men '97 get a trailer

https://www.youtube.com/watch?v=pv3Ss8o9gGQ

10

Nintendo Gaming / Re: The OFFICIAL Big N rumor thread *bring your own salt*

« on: February 11, 2024, 04:30:05 AM »

This says that Switch 2 will have physical and digital backwards compatibility

and that Devs can "enhance" Switch 1 games on the Switch 2

https://universonintendo.com/rumor-proximo-hardware-da-nintendo-tera-retrocompatibilidade-fisica-e-digital-com-jogos-do-switch/

I'm assuming that will be higher frame rates, cleaner textures, higher rez output?

and that Devs can "enhance" Switch 1 games on the Switch 2

https://universonintendo.com/rumor-proximo-hardware-da-nintendo-tera-retrocompatibilidade-fisica-e-digital-com-jogos-do-switch/

I'm assuming that will be higher frame rates, cleaner textures, higher rez output?

11

Nintendo Gaming / Re: The OFFICIAL Big N rumor thread *bring your own salt*

« on: February 09, 2024, 12:53:02 AM »

Rumor has it that Switch 2 reveal could be next month.

I haven't watched the video, but I guess that's what's rumbling out of the rumor mill right now

https://www.youtube.com/watch?v=f1KjvYTv8LA

I haven't watched the video, but I guess that's what's rumbling out of the rumor mill right now

https://www.youtube.com/watch?v=f1KjvYTv8LA

12

Movies & TV / Re: (NEW Poll Added!!) New Movies/TV Shows we should keep an eye out for!

« on: January 26, 2024, 06:53:08 PM »

Dave Patella and Jordan Peele bring us

Monkey Man

https://www.youtube.com/watch?v=g8zxiB5Qhsc

This looks pretty damn cool, so I'm leaving it here so I don't forget about it.

April is a ways away.

Monkey Man

https://www.youtube.com/watch?v=g8zxiB5Qhsc

This looks pretty damn cool, so I'm leaving it here so I don't forget about it.

April is a ways away.

13

Nintendo Gaming / Re: The OFFICIAL Big N rumor thread *bring your own salt*

« on: January 22, 2024, 09:46:44 AM »

I saw an article over the weekend about some company releasing some tech, that stated they were gonna make the drop along side the release of the Switch 2 in September of 2024.

I was on my phone, and away from home, so I kinda lost the page it was on as I was browsing through stuff, but I'll see if I can find it again and share it here.

but until I find it.... here is an updated article of all you we know so far from Polygon https://www.polygon.com/nintendo/23899504/nintendo-switch-2-release-date-power-name-games

edit: It was a press release by Altec Lansing (this 1 of several sources citiing the bolded quote below)

https://www.yahoo.com/lifestyle/nintendo-switch-2-might-hit-175852743.html#:~:text=The%20press%20release%20from%20Altec,Switch%202%20in%20September%202024.%22

Original Press release: (must've been altered as it doesn't mention the bolded quote below)

https://www.prweb.com/releases/altec-lansing-ventures-into-new-territory-as-the-inaugural-licensee-of-ai-sharks-original-gaming-software-302032707.html

I was on my phone, and away from home, so I kinda lost the page it was on as I was browsing through stuff, but I'll see if I can find it again and share it here.

but until I find it.... here is an updated article of all you we know so far from Polygon https://www.polygon.com/nintendo/23899504/nintendo-switch-2-release-date-power-name-games

edit: It was a press release by Altec Lansing (this 1 of several sources citiing the bolded quote below)

https://www.yahoo.com/lifestyle/nintendo-switch-2-might-hit-175852743.html#:~:text=The%20press%20release%20from%20Altec,Switch%202%20in%20September%202024.%22

Original Press release: (must've been altered as it doesn't mention the bolded quote below)

https://www.prweb.com/releases/altec-lansing-ventures-into-new-territory-as-the-inaugural-licensee-of-ai-sharks-original-gaming-software-302032707.html

Quote

Altec Lansing, the leading global audio electronics company, today announces its role as the first licensee of Ai Shark’s cutting-edge gaming software. Formerly known as GameShark, Ai Shark is set to redefine the gaming landscape with its revolutionary AI-enhanced technology. The innovative gaming software is set to mark a significant leap forward in the gaming experience, bringing enhanced gameplay for beginner-level users. The official launch is planned to coincide with the Nintendo Switch 2 in September 2024.

14

Movies & TV / Re: IT'S MAHVEL BAYBEE!! [OT] for the Marvel Cinematic Universe (Movies & TV)

« on: January 22, 2024, 04:13:07 AM »

I would assume the bearer of the Gauntlet was the one person immune to affects of the action made with the Gauntlet.

So let's add that to the equation to keep it more interesting.

So let's add that to the equation to keep it more interesting.

15

Movies & TV / Re: IT'S MAHVEL BAYBEE!! [OT] for the Marvel Cinematic Universe (Movies & TV)

« on: January 21, 2024, 04:08:54 PM »

I saw an interesting proposal for a What If!?... S3 episode, or even a miniseries/multi episode arc.

Thought it would be interesting to discuss.

What if.... The other half blipped

As in Tony Stark, Hulk, Thor, Cap, and Captain Marvel etc etc all blipped, and Black Panther, Bucky, Spider, Wanda and Strange all stuck around....

Does it take them 5 years to figure it all out? Do they win at all? Do they just retest to an alternate dimension in the multiverse?

How would you all imagine that playing out?

Thought it would be interesting to discuss.

What if.... The other half blipped

As in Tony Stark, Hulk, Thor, Cap, and Captain Marvel etc etc all blipped, and Black Panther, Bucky, Spider, Wanda and Strange all stuck around....

Does it take them 5 years to figure it all out? Do they win at all? Do they just retest to an alternate dimension in the multiverse?

How would you all imagine that playing out?

16

Movies & TV / Re: IT'S MAHVEL BAYBEE!! [OT] for the Marvel Cinematic Universe (Movies & TV)

« on: January 20, 2024, 12:55:45 PM »

Iron Heart wraps filming.

Hopefully this is the one to bring the excitement back to the MCU

https://x.com/DEADLINE/status/1748178729397006788?s=20

Hopefully this is the one to bring the excitement back to the MCU

https://x.com/DEADLINE/status/1748178729397006788?s=20

17

Movies & TV / Re: SPOILER ALERT: MCU Thread (Quantum-Ant-Man-ia)

« on: January 20, 2024, 10:13:31 AM »

Apparently don't listen to me..... I guess Echo resonated better with a wider audience beyond me

https://www.hollywoodreporter.com/tv/tv-news/daredevil-born-again-resumes-filming-echo-1235793539/

I didn't hate it, I just felt it didn't do much to invigorate a stagnant MCU TV.

Her fight scene with DD was probably the best fight, and maybe her spreading in other stuff will expand her appeal. For now I'm still not really seeing it.

https://www.hollywoodreporter.com/tv/tv-news/daredevil-born-again-resumes-filming-echo-1235793539/

Quote

The show also had a halo effect for Marvel: Daredevil seasons one and two, Hawkeye, and Punisher season one received major audience bumps, according to insiders.

Marvel is interested in doing more with the character and is already developing new ideas as it seeks to build out its street-level heroes.

I didn't hate it, I just felt it didn't do much to invigorate a stagnant MCU TV.

Her fight scene with DD was probably the best fight, and maybe her spreading in other stuff will expand her appeal. For now I'm still not really seeing it.

18

Movies & TV / Re: Rate the last TV show you've seen

« on: January 13, 2024, 10:29:26 AM »

Echo .... 5/10

Deaf amputee indigenous child taken under Kingpin's wing (for some reason), tries to connect the end of Hawkeye while explaining the past and ongoing relationship between Echo and Kingpin. Also plenty exploration of Echo's Indigenous roots, her connection to her existing family and ancestors, and how that comes to strengthen her today.

Majority of the fight scenes are mid, overall story is weak, and I'm just not really seeing the appeal or point of this particular show, as it didn't even clearly establish what Echo is capable of. All it did in the end, is shuffle Kingpins position on the board, for what I assume will be his role in Daredevil.

Deaf amputee indigenous child taken under Kingpin's wing (for some reason), tries to connect the end of Hawkeye while explaining the past and ongoing relationship between Echo and Kingpin. Also plenty exploration of Echo's Indigenous roots, her connection to her existing family and ancestors, and how that comes to strengthen her today.

Majority of the fight scenes are mid, overall story is weak, and I'm just not really seeing the appeal or point of this particular show, as it didn't even clearly establish what Echo is capable of. All it did in the end, is shuffle Kingpins position on the board, for what I assume will be his role in Daredevil.

19

Movies & TV / Re: SPOILER ALERT: MCU Thread (Quantum-Ant-Man-ia)

« on: January 13, 2024, 10:10:05 AM »

Echo (latest MCU drop)

I just finished this 5 episode run, and while it's nice of Marvel to have it's "Spotlight" brand, and to push inclusion by having a show for the Indigenous, I just really don't see the point of this one, other than to say they were inclusive, and to position Kingpin on the board for Daredevil.

You could skip this in it's entirety, and likely have not missed anything other than "what happened to Kingpins eye!?"

After 5 episodes and several fight scenes, I was still trying to pinpoint what Echo's apparent powers are..... her hands glowed and allowed her to free her fake leg from a moving trains train car hitch.... so I assumed she had super strength or something. Still not sure that's the case, as I looked it up, and her comic version could just mimic whatever she saw..... like Task Master, but also with the ability to also copy music, and not just fighting style. Which I know sure how that would work since Echo cannot hear...

Also, the majority of the fights were unconvincing, and full of too many quick cuts. Not sure it was a choreography thing, a physical ability thing, or an editing thing, but as Marvels Studio's first Mature rated content, it's not really living up to the hype.

Even Kingpin wasn't shown to be the "Force of Strength" I imagined he would be when properly buffed to deal with MCU characters. But I guess we know where he'll be for Daredevil tho. As Mayor of NYC.

I just finished this 5 episode run, and while it's nice of Marvel to have it's "Spotlight" brand, and to push inclusion by having a show for the Indigenous, I just really don't see the point of this one, other than to say they were inclusive, and to position Kingpin on the board for Daredevil.

You could skip this in it's entirety, and likely have not missed anything other than "what happened to Kingpins eye!?"

After 5 episodes and several fight scenes, I was still trying to pinpoint what Echo's apparent powers are..... her hands glowed and allowed her to free her fake leg from a moving trains train car hitch.... so I assumed she had super strength or something. Still not sure that's the case, as I looked it up, and her comic version could just mimic whatever she saw..... like Task Master, but also with the ability to also copy music, and not just fighting style. Which I know sure how that would work since Echo cannot hear...

Also, the majority of the fights were unconvincing, and full of too many quick cuts. Not sure it was a choreography thing, a physical ability thing, or an editing thing, but as Marvels Studio's first Mature rated content, it's not really living up to the hype.

Even Kingpin wasn't shown to be the "Force of Strength" I imagined he would be when properly buffed to deal with MCU characters. But I guess we know where he'll be for Daredevil tho. As Mayor of NYC.

20

Movies & TV / Re: SPOILER ALERT: MCU Thread (Quantum-Ant-Man-ia)

« on: November 29, 2023, 11:10:45 PM »

Seeing the poor box office numbers, I can assume probably no one here other than me has gone to see The Marvels?

TBH, it was a fun film. Kamala was very enjoyable, but they spoiled most of her good moments in the trailers... but that was because they had no other way of marketing the film since the actor strike only ended a day or 2 before the movie came out.

this movie is better than the B.O. would suggest, but at the same time, I don't blame anyone for not rushing out to theater to see this (or most any other movie), knowing it will be on streaming for free in a few months.

The truth of the matter is that the MCU has lost it's hook, it's sense of 'must watch it now' before I am spoiled, because End Game was the perfect climax, and nothing since has felt all that connected or like a major event that needs to be experienced NOW.

having said all that..... go watch The Marvels

so I'm not alone in here. lol

TBH, it was a fun film. Kamala was very enjoyable, but they spoiled most of her good moments in the trailers... but that was because they had no other way of marketing the film since the actor strike only ended a day or 2 before the movie came out.

this movie is better than the B.O. would suggest, but at the same time, I don't blame anyone for not rushing out to theater to see this (or most any other movie), knowing it will be on streaming for free in a few months.

The truth of the matter is that the MCU has lost it's hook, it's sense of 'must watch it now' before I am spoiled, because End Game was the perfect climax, and nothing since has felt all that connected or like a major event that needs to be experienced NOW.

having said all that..... go watch The Marvels

so I'm not alone in here. lol

21

Movies & TV / Re: Rate the last TV show you've seen

« on: November 28, 2023, 08:37:23 PM »Question: What is the sequel to Loki? Quantum of something?

you mean Ant-Man: Quantumania?

since it's the next appearance of a version of Kang the Conquerer?

22

General Chat / Re: NBA Thread: Brought To You By The Tampa Bay Raptors Of Toronto

« on: November 16, 2023, 01:21:36 AM »

how dare you make a direct comparison of the Stifle Tower to Captain America!?

You think that A stands for FRANCE!!!!??

You think that A stands for FRANCE!!!!??

23

Movies & TV / Re: All Things Netflix! Coming Soon: The Netflix Experience, Live and In Person!??

« on: November 13, 2023, 02:23:26 AM »

Netflix just had what they call the Geeded Week 2023 that list a bunch of stuff that was coming out the end of this year.

Some of it is already out, and really good, such as Blue Eyes Samurai, but there are trailers for about 4 dozen titles coming to Netflix soon, if they aren't already out

https://www.youtube.com/playlist?list=PLvahqwMqN4M02OJC_APnQ6iADjvL959Nx

[youtube]http://www.youtube.com/playlist?list=PLvahqwMqN4M02OJC_APnQ6iADjvL959Nx[/youtube]

Some of it is already out, and really good, such as Blue Eyes Samurai, but there are trailers for about 4 dozen titles coming to Netflix soon, if they aren't already out

https://www.youtube.com/playlist?list=PLvahqwMqN4M02OJC_APnQ6iADjvL959Nx

[youtube]http://www.youtube.com/playlist?list=PLvahqwMqN4M02OJC_APnQ6iADjvL959Nx[/youtube]

24

Movies & TV / Re: Rate the last TV show you've seen

« on: November 06, 2023, 01:39:11 AM »

New Netflix Anime

Blue Eyed Samurai

- just bonged this over the weekend, and really thought it was well done.

Animation was really good, and the story and characters I felt were also really well written.

there's a small twist that's revealed early on, but I honestly expected it almost immediately, but that only adds to what is happening, not takes away from it.

[minor spoiler related to minor twist]

There is however a really heavy feminist slant, as this is written by woman and contains lots of strong female characters, but I think overall it's really well done and not overly thrown in your face till the end.

The premise is about a blue eyed half breed Japanese kid who is bullied as a "monster" into becoming a samurai who is hell bent on getting revenge not necessarily on those that bullied, but on those that made the main the character a monster.

and to top it off, all the action in this is great. not a bad episode in the bunch.

definitely recommended for all the older anime and action fans, especially those looking for an animation style more reminiscent of Arcane.

https://www.youtube.com/watch?v=nJ1yQn17lbE

Blue Eyed Samurai

- just bonged this over the weekend, and really thought it was well done.

Animation was really good, and the story and characters I felt were also really well written.

there's a small twist that's revealed early on, but I honestly expected it almost immediately, but that only adds to what is happening, not takes away from it.

[minor spoiler related to minor twist]

There is however a really heavy feminist slant, as this is written by woman and contains lots of strong female characters, but I think overall it's really well done and not overly thrown in your face till the end.

The premise is about a blue eyed half breed Japanese kid who is bullied as a "monster" into becoming a samurai who is hell bent on getting revenge not necessarily on those that bullied, but on those that made the main the character a monster.

and to top it off, all the action in this is great. not a bad episode in the bunch.

definitely recommended for all the older anime and action fans, especially those looking for an animation style more reminiscent of Arcane.

https://www.youtube.com/watch?v=nJ1yQn17lbE

25

General Chat / Re: Mortgage Rates are DROPPING. I am a Loan Officer - Any Questions?

« on: November 06, 2023, 01:28:32 AM »

they are slowly ticking down over the last week... but not enough to make a difference for most.

I know in Canada they also do not have 30yr fix mortgages....must be rough.

Here in the US though, we're not really expecting anything major in rate reductions till sometime mid to late next year, which sucks, and is also an estimate I really hope proves to be wrong, as I really hope reductions in rates start happening much much sooner than that.

I know in Canada they also do not have 30yr fix mortgages....must be rough.

Here in the US though, we're not really expecting anything major in rate reductions till sometime mid to late next year, which sucks, and is also an estimate I really hope proves to be wrong, as I really hope reductions in rates start happening much much sooner than that.